Today the Daily Mail is again talking about how the UK was on the edge of an economic apocalypse before George Osborne saved the day! Some things never change.

What would be more interesting would be to actually look at the economic data beneath the political and journalistic hyperbole, wouldn't it?

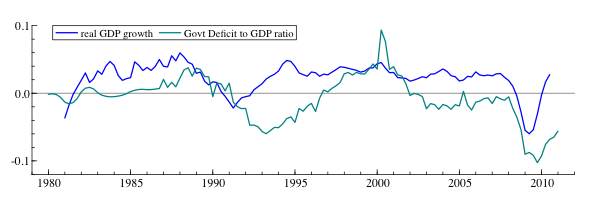

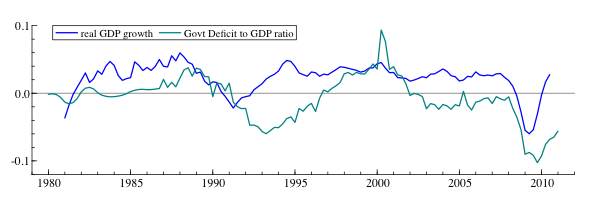

I'm writing up some long overdue notes for some lectures I did on fiscal policy, and I figured I'd just have a little look at the government deficit in the context of real GDP growth in the UK over the past 30 years. Here's what the two data series look like:

Why am I doing this? Well because when an economy enters a recession, things economists call automatic stabilisers kick in: Benefits are paid to people made unemployed, and income and corporation tax receipts fall since less profits are made and less income is earned. These two effects will make a budget deficit worse regardless of how profligate a government is, so long as it provides unemployment benefits, and runs an income and corporation tax system.

So what about the biggest recession in 70 years kicking in? Surely that's going to have quite an impact on government finances, right? Looking at the two series above, we can see that indeed the recession we just emerged from was deeper than anything since 1980, and indeed the government deficit was also deeper. It's interesting to note the 1992 recession, post-ERM. After that, there is quite a large budget deficit for quite a while. Interestingly enough, that deficit only becomes a surplus after 1997.

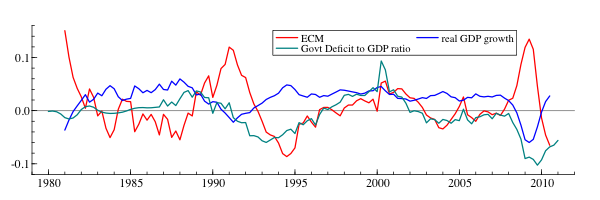

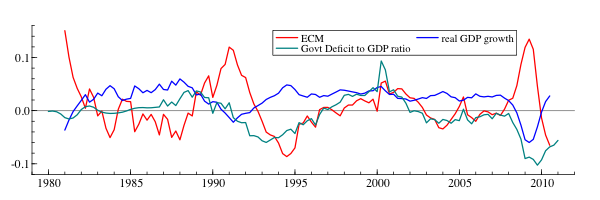

However, we should really think about taking the data seriously, shouldn't we? Eyeballing only gets one so far. Now both series are probably stationary (econometric speak), but clearly show persistence - GDP growth is strong for a while, then weak, deficits tend to hang around like bad stains. So we should think about a dynamic econometric model. The real beauty of such models (say, an Autoregressive Distributed Lag model) is that we can let the data tell us about the long run solution, or error correction reformulation as it's called in the linked paper. This is the long-run relationship between the two variables: So if real GDP growth is at its expected value, what do we expect the deficit to be?

This way we can say: How far out of equilibrium are we right now, compared to economic history? I'm not going to bore anyone with the details (email me if you'd like them, I'm more than delighted to provide), but of course it's fascinating to look at something like this and see just how much we are currently teetering on the brink. The red line in the following diagram shows us exactly how far out of equilibrium we are currently:

The deficit and real GDP growth are also plotted there still. The red line is equilibrium, or how much too high or too low is the deficit given the state of the economy. The important thing is that this is estimated over real data, and it should also be said that this is data starting in 1981, so 16 years of a Conservative government then followed by 13 years of Labour - it's a nice mix of the two.

So we see the impact of the financial crisis with a big positive movement which looks bad, right? That is until you realise that this is saying that the deficit was not large enough given the size of the contraction in real GDP! Calculations, based on the data, says that at the height of the recession, when real GDP contracted at 6%, the correct deficit given past UK economic history (16 years of Conservatives), excluding all economic theories, the deficit should have been an eye-watering 22% of GDP, not the trifling 9% it was at this point (2009Q2). Only as we entered 2010 did the equilibrium relationship (called ECM) turn negative, suggesting the deficit is too high now, and even by 2010Q3 it had not reached the depths of disequilibrium (a deficit too high) it reached in 1994.

Interesting stuff. Are we teetering on the brink of an economic apocalypse? Were Labour reckless with public finances? Not if you consider economic data taking into account Conservative policies between 1981 and 1997, at any rate.